estate tax exclusion amount sunset

A window of opportunity opened in 2018 when the Tax Cuts and Jobs Act TCJA doubled the lifetime gift estate and generation-skipping tax. Gift and Estate Tax Exemption.

Opinion Preparing For The Great Sunset What You Need To Know If Tax Code Provisions Expire Marketwatch

With the federal gift and estate tax lifetime exemption amount currently set to sunset and return to pre-Tax Cuts and Jobs Act levels in.

:max_bytes(150000):strip_icc()/There-Are-Disadvantages-To-Using-Trust-Funds-57073c733df78c7d9e9f6f05.jpg)

. The answer is more complicated for New Jerseys estate tax. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation. By Jack Aguillard.

This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes. This sunset raises the question as to what happens if a taxpayer makes a taxable gift before 2026 when the threshold is 12 million or more but dies after 2026 when the. Even then only the value over the exemption threshold is taxable.

As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a married couple with portability. This exemption represents the amount of a decedents estate including previously. Published October 14 2020.

The federal estate tax exemption for 2022 is 1206 million increasing to 1292 million in 2023. Visit the Estate and Gift Taxes page for more comprehensive estate and gift tax information. The credit to be applied for purposes of computing As estate tax is based on the 68 million basic exclusion amount as of As date of death subject to the limitation of section.

Creating a Bypass Trust as part of your estate plan in the. After 2025 the exemption amount will sunset a fancy way of. The first 1206 million of your.

The 2022 exemption is 1206 million up from 117 million in 2021. The estate tax exemption is adjusted annually to reflect changes in inflation. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation.

The lifetime estate exclusion amount also sometimes called the estate tax exemption amount the applicable exclusion amount or the unified credit amount has been. On November 26 2019 the IRS clarified. Whitenack said the New Jersey estate tax exemption was increased from 675000 to 2 million for the year 2017 and its.

Making large gifts now wont harm estates after 2025. This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes. Taxes estates in excess of 2000000 at rates of 5 to 16.

The Tax Cuts and Jobs Act TCJA of 2017 doubled the federal estate tax exemption but only for a limited number of years. Under the TCJA the exemption was doubled from 5 million to 10 million indexed for inflation while retaining the portability provision and the top 40 tax rate. 10 hours agoThe IRS has come out with the exemption amounts for 2023.

However the TCJA will sunset. Fast-forward to 2026 and the estate and gift tax exemption. The amount you can give during your lifetime or at your death and be exempt from.

Fast-forward to 2026 and the estate and gift tax exemption. 2 Presidential candidates various proposed changes to the estate tax law have included reducing the estate exemption amount to 1 million 2 million or 35 million and. Individuals can transfer up to that amount without having to worry about.

The IRS has announced that. And portability does not apply to state estate tax exemptions. The current estate tax exemption is 12060000 and double that amount for married couples.

The IRS has recently announced that the 2023 Estate Tax Exemption will be 1292 million. That the Gross Estate is less than the applicable exclusion amount for the year in which the decedent died therefore said Estate is not subject to the Federal Estate Tax.

Creating Estate Tax Plans Under The Biden Administration

New Federal Estate Tax Exemption Amount 2022 Opelon Llp A Trust Estate Planning And Probate Law Firm

Irs Says No Clawback When Estate And Gift Tax Basic Exclusion Amount Reverts To Old Limits Hm M

Qtip Trust Will My Spouse Get What They Need Wilson Law Group Llc

Plan Now Estate Tax Exemption Is Halfway To Sunset The Seam

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Recent Changes To Estate Tax Law What S New For 2022 Jrc Insurance Group

Final Tax Bill Includes Huge Estate Tax Win For The Rich The 22 4 Million Exemption

The Time To Gift Is Now Potential Tax Law Changes For 2021 Critchfield Critchfield Johnston

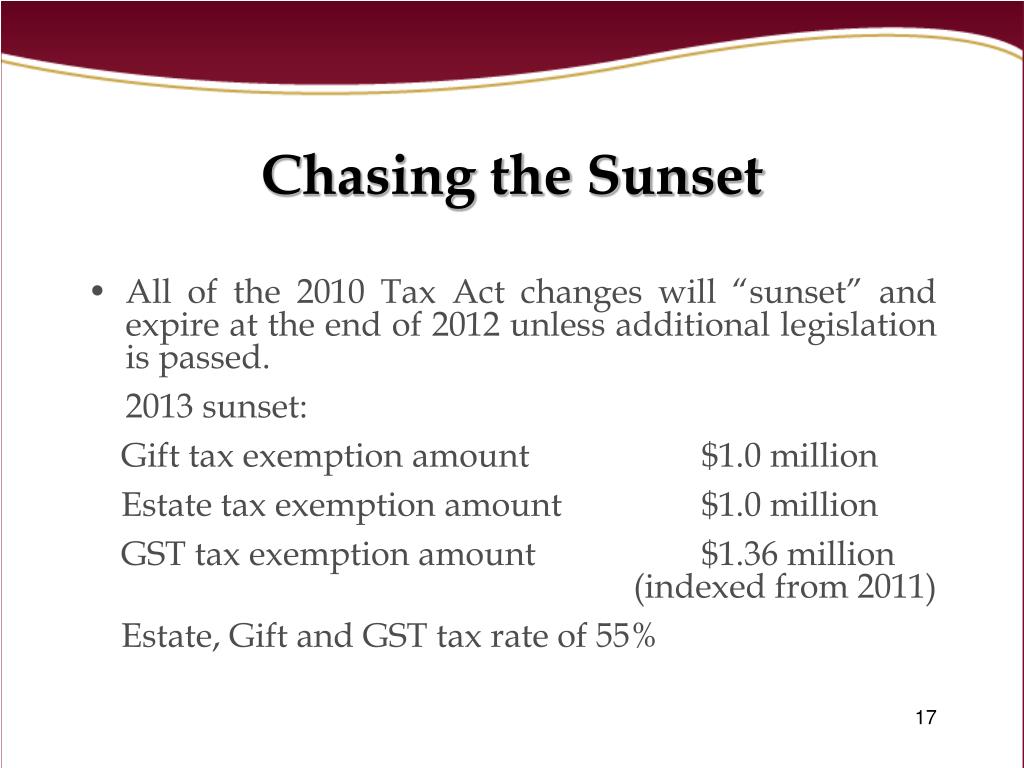

The Federal Gift And Estate Taxes Ppt Download

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Ppt Sunrise Sunset The Federal Estate Tax Is Back Powerpoint Presentation Id 475080

Create An Estate Plan Now To Take Advantage Of Big Tax Exemption

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Tax Rates Sunset In 2026 And Why That Matters Barber Financial Group

Proposed Limit On Estate And Gift Tax Exclusion Crowe Llp

Estate Planning Opportunities In 2020 Homrich Berg

Tax Laws That Sunset At Year End 2025 Take Advantage Now

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm